Got a Strange Text? 5 Signs That You’re Being Scammed (and How to Protect Yourself)

We’ve all received a text urgently asking for personal or financial information. Or advertising an offer that sounds a bit too good to be true. Or threatening to close an account if you don’t act quickly.

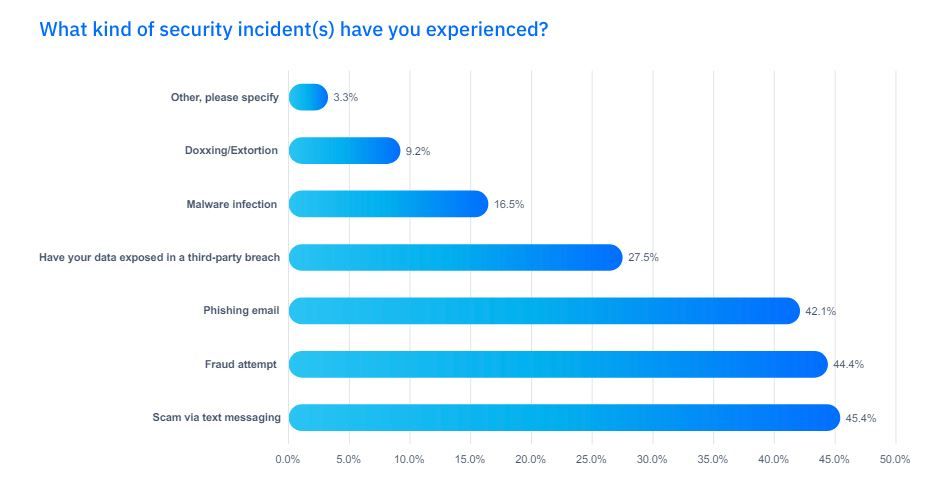

According to the results in the Bitdefender 2024 Consumer Cybersecurity Assessment Report, text-based scams are the most common threat consumers face today.

Credit: Bitdefender 2024 Consumer Cybersecurity Assessment Report

Yet four in five netizens make sensitive transactions on their phones without adequate cybersecurity practices – all while saying they most fear hackers accessing their money.

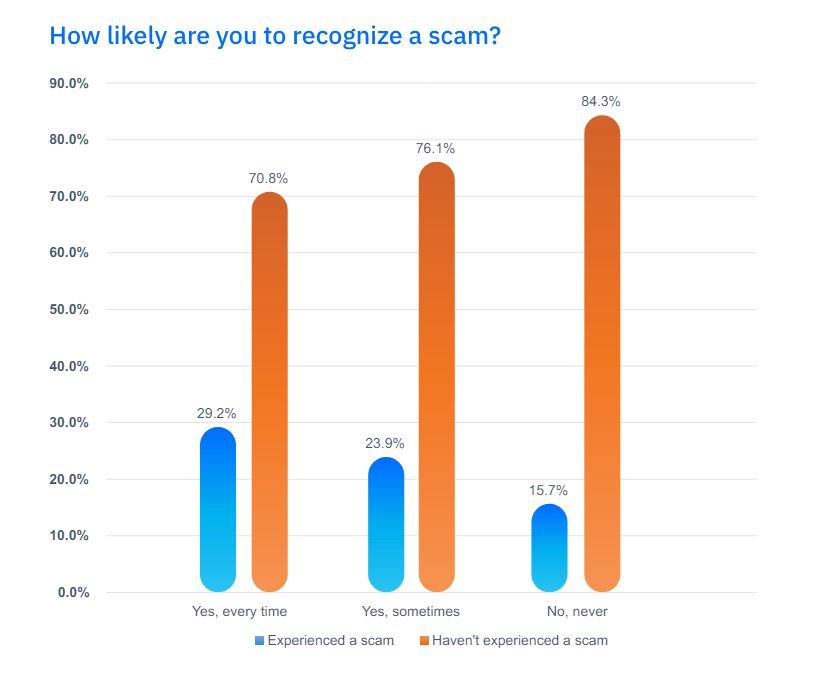

We also asked respondents how good they considered themselves at recognizing a scam. According to the results, people who say they can recognize a scam are more likely to have suffered one (29%), versus those who don’t always (24%), or never (16%) recognize scams.

Credit: Bitdefender 2024 Consumer Cybersecurity Assessment Report

This indicates that people who can’t recognize a scam may have experienced one without knowing. So it’s important to spot the red flags before it’s too late. Here are the five most common signs that you’re being scammed and how to protect yourself.

1. Unsolicited Communication

Red Flag: One of the most common signs of a scam is receiving an unsolicited email, text or phone call. Scammers often pose as legitimate companies or government agencies, claiming there's an urgent issue with your account or a prize you’ve won.

In a recent example, the FBI warned cryptocurrency holders to keep watch for scams impersonating crypto exchange employees asking for login information. The alert, issued Aug. 1, details the ruse scammers typically use to access crypto wallets and transfer the funds to their own pockets

- The scammer contacts the victim via an unsolicited call or message and pretends to be a cryptocurrency exchange employee

- The scammer conveys a sense of urgency and may claim there is a problem with the victim's account, or that someone is trying to compromise it

- The scammer claims the victim must safeguard their account by providing login information, clicking on a link, or sending identification information

- The scammer obtains access to the victim's account and steals the cryptocurrency

How to Protect Yourself: Be skeptical of unexpected messages, especially if they ask for personal information or immediate action. Verify the sender's identity by contacting the company or organization directly using official contact details from their website. Do not click on links or download attachments from unknown sources.

2. Too Good to Be True Offers

Red Flag: If an offer seems too good to be true, it probably is. Scammers often lure victims with promises of easy money, amazing deals, or guaranteed prizes that are far beyond what you’d typically expect.

In June, the US Department of Justice announced the sentencing of two US nationals found guilty of mass-mailing fraud for selling consumer data to fraudsters who then targeted vulnerable citizens with fake prizes.

At trial, victims and their adult children testified about the scam letters falsely promising cash prizes. Evidence presented showed that victims had been targeted for fraud by members of a conspiracy, which included the employees of a large marketing services firm.

How to Protect Yourself: Always question the validity of offers that sound overly generous. Research the company or offer. Look for reviews or scam reports on the subject. Be cautious about sharing personal or financial information in response to such offers. In general, be skeptical about calls or texts promising winnings out of the blue – especially if the “offer” asks for an upfront payment from you. Chances are someone is trying to dupe you.

3. Pressure to Act Quickly

Red Flag: Scammers typically create a sense of urgency to pressure you into making a hasty decision. They might claim that your account will be suspended, you owe back taxes, or a limited-time offer is about to expire.

Americans lost over a billion dollars to scammers impersonating businesses or government agencies in 2023, the Federal Trade Commission said in April. Reported losses to impersonation scams topped $1.1 billion, more than triple what consumers reported in 2020. Most reports involved copycat account security alerts, phony subscription renewals, fake giveaways, discounts, or money to claim, bogus problems with the law, and made-up package-delivery problems.

How to Protect Yourself: Take a step back and resist the urge to act immediately. Scammers thrive on panic, so slowing down and thinking critically is crucial. If someone is pressuring you to decide on the spot, it’s likely a scam. Take time to verify the details before taking any action.

4. Requests for Personal or Financial Information

Red Flag: Legitimate companies rarely ask you to share sensitive information like passwords, Social Security Numbers, or bank details via email or over the phone. Scammers, however, often ask for this information to steal your identity or money.

The Federal Trade Commission (FTC) recently warned that scammers are targeting job seekers with unsolicited messages on instant messaging platforms, promising remote jobs that pay up to $600 a day. Once victims engage with the scammers, they’re asked to supply personal information, including their Social Security Number, under the pretext that it’s required for background checks or to set up a direct deposit for the salary. Once a scammer grabs your SSN, they can commit identity theft, open credit accounts in your name, or file false tax returns.

How to Protect Yourself: Never share your personal or financial information unless you are absolutely sure of who you are dealing with. If someone asks for this information, ask why it’s needed and if there’s an alternative way to verify your identity. Use secure channels like official websites or apps to manage sensitive information.

5. Suspicious Payment Methods

Red Flag: Scammers often ask for payments via unconventional methods like gift cards, wire transfers, or cryptocurrency, which are hard to trace and nearly impossible to reverse. They might claim that these methods are more secure or offer discounts for using them.

Phone scammers were recently caught impersonating the US Cybersecurity and Infrastructure Security Agency (CISA) requesting cash, cryptocurrency, and even gift cards.

How to Protect Yourself: Legitimate organizations or government agencies never contact you with such a request. More importantly, they never try to anonymize the discussion or transaction.

Be wary of any request to pay through non-traditional methods. Legitimate businesses typically offer secure, traceable payment options like credit cards or PayPal. If someone insists on an unusual payment method, it’s a strong indicator of a scam. Always opt for secure, traceable payment methods and avoid deals that require non-standard forms of payment.

Conclusion

Watch out for these red flags to keep cyber scams at bay! Always verify the legitimacy of any communication, offer, or payment request before taking action. When in doubt, seek advice from trusted sources.

Bitdefender recently published a straightforward guide on how to exercise good cybersecurity hygiene to fight the rising tide of scams targeting regular folk.

Read: Make It Hard for Scammers to Get You! Use These Seven Vital Tips.

Consider using Scamio to combat socially engineered attacks on your phone or computer. If you're suspicious about a certain phone call, email or SMS, Scamio provides a fast and efficient way to find out if you’re being conned. Simply describe the situation to our clever chatbot and let it guide you to safety. You can share with Scamio the exact thing you want to check: a screenshot, PDF, QR code or link. Scamio lets you know in seconds if it’s a scam. Use it anywhere via web browser, Facebook Messenger, or WhatsApp. Scamio is localized for use in the USA, France, Germany, Spain, Italy, Romania, Australia and the UK.

tags

Author

Filip has 15 years of experience in technology journalism. In recent years, he has turned his focus to cybersecurity in his role as Information Security Analyst at Bitdefender.

View all postsRight now Top posts

How to Protect Your WhatsApp from Hackers and Scammers – 8 Key Settings and Best Practices

April 03, 2025

Outpacing Cyberthreats: Bitdefender Together with Scuderia Ferrari HP in 2025

March 12, 2025

Streamjacking Scams On YouTube Leverage CS2 Pro Player Championships to Defraud Gamers

February 20, 2025

How to Identify and Protect Yourself from Gaming Laptop Scams

February 11, 2025

FOLLOW US ON SOCIAL MEDIA

You might also like

Bookmarks